I want to address a cultural flaw that, in my opinion, underlies our human predicament.

We consume too much. The planet cannot provide everyone on this spinning sphere with the oversized appetites for things that we Americans and many other citizens of the developed world feed. We keep buying more: bigger homes, bigger vehicles, more recreational toys. People, even some environmentalists, believe we just need to replace fossil fuel energy with renewable sources, be it solar or wind. In this view, as long as the power is fossil-free we can continue to consume as we did before without guilt or serious impacts. But remember, those energy forms, too, require resources mined and manufactured, sometimes creating their own hazards in someone else’s backyard, far from our field of vision. This does not even factor in what it is like to do the necessary work along the supply chain to create, assemble or install that which we consume.

As consumers we have responsibilities that we too easily shrug off. That is not to say that the producers do not also have responsibilities for that which they produce. They should in fact take more responsibility, which I will get to shortly. As a longtime volunteer in community recycling programs, we are always gratified that people take the little bit of effort to recycle some of their discards rather than bury them in a landfill. That is a key decision point. Single-stream recycling makes this easy on the resident, as opposed to separating the glass from the metal and plastic and paper. But not sorting it also pushes that work on to someone else. And if you have ever visited a materials recovery facility (MRF), you might be repulsed at the prospect of working there 40 hours a week, at low wages and limited, if any benefits. It is bad enough as only a monthly volunteer at a source-separated site, given many residents’ reluctance to simply rinse an item before throwing it in the mix. Yuck!! ,

As consumers, not only do we need to consume less, but we need to push back on producers to reduce their impacts, both in the production of the product itself and the packaging that we are left to find a home for. Consumer goods should be designed and made to be either repairable for reuse or at least disassembled so that the materials can be easily added to the production supply chain. Better yet, make the producer take the product back at the end of its life and support the reclamation of the packaging they use. That will require that we salvage all that we can and get it into the hands of the nearest responsible manufacturer. Doing so will greatly reduce the amount of energy consumed, whether fossil or renewable based, as well as the demand for mining new materials and the production of additional potentially hazardous waste.

My colleague, Dr. Rex LaMore, proposed some years back, that builders and developers should be required to put money in an escrow account to cover future deconstruction of any building they construct when it reaches its useful end of life. Think of the total embodied energy and materials that went into building a Walmart, Kmart, or Sears store that finally closes shop. What does a community do with that building and the huge concrete or asphalt parking area?

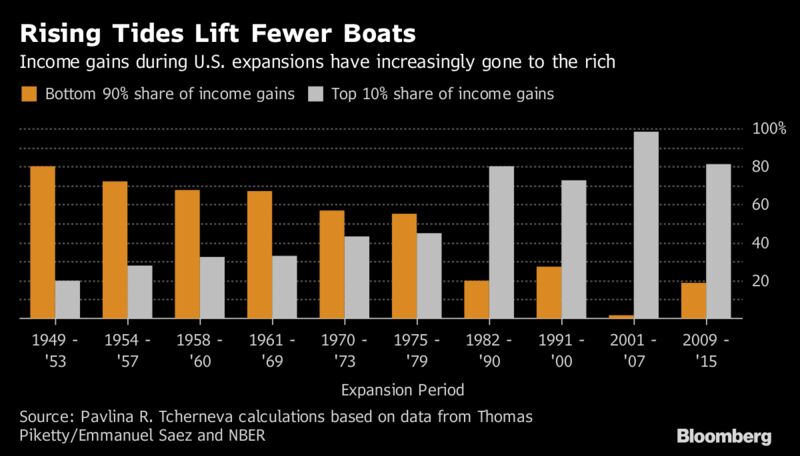

To close this loop—“circular economy” is the new catchphrase--we need to use less. But when we buy we should buy more used and reconditioned products and those with recycled content. To keep the loop sustainable, items being recycled must be clean and sorted to minimize the contamination that hinders reutilization of salvaged materials. This is a responsibility for consumers, especially here in the developed world where we have the biggest ecological footprints. The outrageous and increasing income inequality on this finite and fragile planet demands our attention to this. July 29, 2021 is this year’s overshoot day – a day by which the human family has “exhausted nature’s budget for the year.”

Once upon a time there was a simple technology called a broom or a mop. It was a simple construction of renewable materials. We used these to clean our homes. The vacuum cleaner was invented for the new carpets with longer fibers for which a broom or mop was less effective. The vacuums needed electricity to work (while there were non-electric sweepers like those made by Bissel, once shag carpeting appeared even those were not effective). These vacuum machines are made up of all types of different materials– metal, various plastic resins, electronics, wire, etc.--and aren’t always easy to disassemble. They were probably produced half a world away before arriving at Target or Best Buy and making their way into our closets at home.

Vacuums are simple technologies; I’ve repaired a few myself (that’s how simple they are!). You can even buy new parts like the rubber belts that eventually wear out, if you keep the same machine for a decade or more. But how about that desktop printer? Sure, you have to buy ink cartridges. But once it starts acting up, you’re likely to buy a new one as almost no one repairs them, parts are not readily available, and new ones are relatively inexpensive, at least cheaper than many repairs. But even here we can lessen our footprint by refilling the ink jet cartridges rather than buying new ones.

But the larger systems push back against this. When something breaks our tendency is to just get a new one. It is more “cost efficient” to just replace old with new. Sometimes the immediate cost is cheaper, but environmentally it’s not. It’s the same with accidents. When a car is “totaled” it simply means the financial cost to repair it is more than the resale value of the car. But the environmental cost of producing a new car, or a new roof, or a new anything is almost always higher, because the extra energy and mining and manufacturing of new materials, but it’s externalized. Even the insurance system reinforces this because they only look at out-of-pocket expenses, so why repair a few damaged parts when it costs as much to replace the whole dang thing? And we accept it, because we are hooked into thinking of “out-of-pocket” costs as the primary test. I suffer from it too, even as I decry its impact.

Another underlying force we should push back on is the distinction between “wants” and “needs.” The advertising industry works on sparking the “wants” and then pushing that to a “need” level. Perhaps if we asked ourselves a question like the following before we jump down the consumer rabbit hole we might pause: “If I don’t buy this item now, in ten years will I have felt my life was diminished?” If our lives are that connected with things as opposed to experiences and relationships, will we really find true fulfillment and meaning? If we look at our brethren in the developing world, what would we be willing to reduce so that they might have a little more security? Could we lower the thermostat one or two degrees in the winter and raise it one or two in the summer? Would we pay a little more to keep local responsible businesses thriving in our communities? Might we turn off lights when we aren’t using them? Will we pay a bit more to support responsible businesses, which endeavor to lighten their impacts and share with their workers and local communities?

As the world community comes together this November under the umbrella of the United Nations Climate Summit, we owe it to these neighbors who suffer as a result of our own energy and resource consumption to make some commitment to fairness and justice. Perhaps we can begin to look inside ourselves to see what we are called to do – to take care of each other and conserve what we have.